Trump's tariffs, US-China trade relations, and a wave of AI investment are among the issues that could shape the global economy in 2026.

Domestic steel consumption continued to grow positively in the second quarter, helping to significantly improve the business results of steel industry enterprises.

Steel consumption recovers in first half of the year

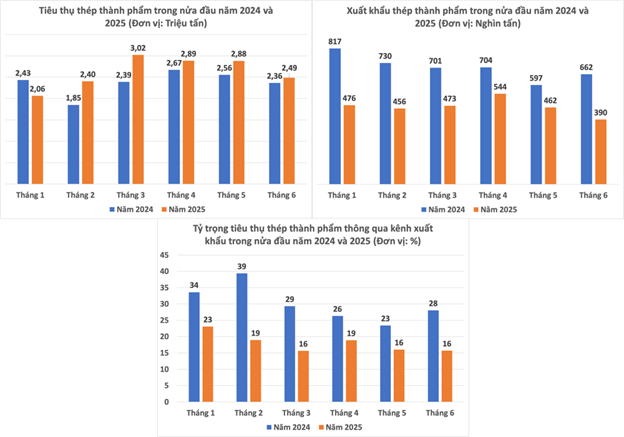

According to the latest figures from the Vietnam Steel Association (VSA), finished steel sales in the second quarter reached 8.25 million tons, up 10% compared to the first quarter and nearly 9% compared to the same period last year. Meanwhile, steel exports continued to decline by 29% compared to the same period last year to below 1.4 million tons. HRC steel exports recorded the sharpest decline of up to 45%.

In the context of complicated tariff situations in major markets, the growth momentum of steel consumption is maintained mainly thanks to the support of the domestic market as the Government is promoting the implementation of public investment projects, helping to support the consumption of steel products.

In the first half of this year, businesses consumed 15.7 million tons of steel, up 10% over the same period last year. Most steel products recorded double-digit growth of 10-18%, while galvanized steel decreased by 8%.

Notably, export activities in the first half of the year decreased sharply by 32% compared to the same period last year to 2.8 million tons. The proportion of steel consumed through export channels as of June was only about 16%, much lower than the 28% in the same period last year.

Many businesses report good news

Improved steel consumption has partly helped improve the business results of some enterprises in the industry.

Opening the steel industry, Vicasa Steel Joint Stock Company - Vnsteel (Code: VCA) has just announced its second quarter financial report with revenue soaring to VND 574 billion, up 65% compared to the second quarter of 2024 and the highest level since the second quarter of 2022 (highest in the last 13 quarters). Pre-tax profit was over VND 2.5 billion, up 211% over the same period.

Accumulated in the first 6 months of the year, Vicasa Steel had net revenue of 885 billion VND, up 40%. High costs caused pre-tax profit to increase by only 14% to nearly 2.6 billion VND.

Or Hoa Phat Group (Code: HPG) recorded the highest profit in the second quarter in 13 quarters. Specifically, revenue in the second quarter reached more than 36,000 billion and profit after tax was 4,300 billion VND. This profit figure is 30% higher than the same period last year and is the highest level since the second quarter of 2022.

In the first 6 months of the year, Hoa Phat achieved revenue of more than 74,000 billion VND, profit after tax reached more than 7,600 billion VND, increased by 5% and 23% respectively over the same period last year, achieving 44% of revenue target and 51% of profit target.

The Group produced 5.1 million tons of crude steel, up 17% compared to the first 6 months of 2024. Sales of HRC, construction steel, high-quality steel and steel billets reached 5 million tons, up 23% compared to the first half of last year. Hot-rolled coil alone increased by 42%.

Steel and related products group contributed nearly 90% to the group's consolidated revenue; The agricultural sector achieved high results with revenue and after-tax profit growing by 38% and 130% respectively.

The Group said it will complete blast furnace No. 6, part of phase 2 of the Hoa Phat Dung Quat 2 Iron and Steel Complex project, in September 2025. After completion, the Group's total steel output will reach a total of 16 million tons/year, including 9 million tons of hot-rolled coil steel, meeting 100% of the demand for this product in the Vietnamese market.

Although it has not yet announced its second quarter business results, Vietnam Steel Corporation (VNSteel, code: TVN) also shared positively that its steel consumption in the first half of this year increased by 20% compared to the same period last year, reaching more than 2 million tons. Of which, long steel consumption increased by 30% and galvanized steel increased by 20%.

Hoa Sen Group (Code: HSG), the market leader in galvanized steel products, said that in the third quarter of the 2024-2025 fiscal year (from April 1, 2025 to June 30, 2025), consolidated revenue is estimated to decrease by 12%, HSG's consolidated after-tax profit is estimated at VND 274 billion, almost unchanged compared to the same period.

Accumulated in the first 9 months of the 2024 - 2025 fiscal year (from October 1, 2024 to June 30, 2025), the enterprise's consolidated output is estimated at 1.42 million tons, achieving 73% of the plan, consolidated revenue is estimated at VND 28,176 billion, achieving 74% of the plan. Meanwhile, consolidated profit after tax is estimated at VND 647 billion, exceeding 29% of the profit plan set out in the high option (VND 500 billion).

The fact that Hoa Sen completed its profit plan earlier than its revenue and output shows that the company has a higher profit margin than expected.

In the domestic market, in addition to promoting production and business activities and taking advantage of the business advantages of key products such as corrugated iron, steel pipes, and plastic pipes, the enterprise also focuses on developing the Hoa Sen Home Construction Materials & Interior Supermarket chain nationwide.

What is the driving force for the steel industry at the end of the year?

The outlook for the steel industry from now until the end of the year is still considered to have many bright spots. In a recent analysis report, VPBank Securities Joint Stock Company (VPBankS) said that the demand for construction of civil real estate projects this year will continue to remain high thanks to three main driving forces.

First, the Government has introduced many solutions to remove legal obstacles in real estate projects. Second, total registered FDI capital in the first 5 months of 2025 in the real estate sector increased sharply by 150% compared to the same period - the highest level in the past 8 years. Finally, interest rates are still maintained at a low level.

Regarding HRC export activities, VPBankS believes that Hoa Phat will record an export growth of about 3.3% this year thanks to the benefit from the EU's anti-dumping tax decision. On July 16, the European Commission (EC) issued a final decision on the anti-dumping investigation on some hot-rolled steel products imported from Egypt, Japan and Vietnam.

Accordingly, Hoa Phat HRC steel exported to Europe is subject to a 0% tax rate, while the European tax rate for other Vietnamese enterprises is 12.1%. This result is similar to the EU's preliminary assessment in April. For other suppliers, Japanese hot-rolled steel imported to the EU is subject to a tax rate of 6.9% - 30.4%, while Egypt is subject to a tax rate of 11.7%.

In addition, VPBank believes that there is a high possibility that HRC prices in the US will continue to differ significantly from those in Vietnam. As of the end of June, HRC prices in the US were about 80% higher than those in Vietnam.

In the domestic market, Vietnamese HRC producers benefit from anti-dumping duties applied to imports from China.

In early July, the Ministry of Industry and Trade decided to officially impose anti-dumping duties on some hot-rolled steel (HRC) products imported from China at rates ranging from 23.1% to 27.83%. This tax rate will take effect from July 6 and last for 5 years, unless extended, changed or canceled according to regulations.

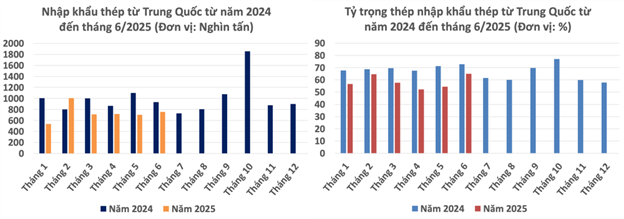

In fact, since the imposition of temporary anti-dumping duties in February, steel imports from China have dropped sharply. According to Vietnam Customs, steel imports from China in the first half of this year fell sharply by 22% to 4.4 million tons. Although it is still the largest market for steel imports from Vietnam, the proportion of goods from China as of June fell to 65%, compared to 73% in the same period last year. This proportion had dropped to 52% in April.

Source: Vietnam Customs (compiled by H.My)

In a recent analysis report, MB Securities JSC (MBS) said that the anti-dumping tax is expected to have a positive impact on domestic HRC consumption in the period 2025 - 2026. Thanks to reduced price competition with Chinese steel, the domestic HRC market share is expected to improve to 40% (compared to about 25% in 2024).

Regarding the construction steel segment, MBS believes that prices may recover from the third quarter thanks to the industry’s consumption forecast to grow by over 15%. In addition, the pressure from Chinese steel has cooled down as the country has sharply cut production since the third quarter.

MBS forecasts that this year construction steel prices may increase by 4-5% and HRC prices may increase by 3-4%.

Besides opportunities, the Vietnamese steel industry still faces many risks. In fact, in June alone, consumption began to slow down. VSA said this was the first month to record a decrease in output and sales of steel products after 4 consecutive months of growth.

The steel market has entered the rainy season, so the demand for steel for projects and civil use has begun to slow down. Accordingly, steel sales in June decreased by 14% compared to May to 2.5 million tons.

VPBankS believes that HRC consumption in the domestic market may be under pressure from the decline in demand from galvanized steel producers. Accordingly, total galvanized steel consumption in 2025 may decrease by 10%, mainly due to the negative impact of anti-dumping and countervailing duties and low demand for galvanized steel in the US market.

Looking at the longer-term outlook, VPBank points out 3 risks in 2026.

First, Vietnam’s safeguard tax on long steel will expire in March 2026 if not extended. In case the safeguard tax expires and is not extended, VPBank believes that domestic enterprises will face the risk of price competition with imported Chinese construction steel products.

Second, the CBAM mechanism will come into effect from the beginning of 2026, reducing the profit of export orders to the EU. Specifically, from January 1, 2026, EU importers will have to purchase and present CBAM certificates for the net emissions of imported goods corresponding to the price and free quota schedule of the ETS system within the EU.

Finally, interest rates may rise sharply again, making it difficult to finance real estate projects, indirectly affecting steel consumption demand.

(Source: Vietnambiz)

--

Oristar – Leading Metal Supplier in Asia

⚡ Core product lines: Copper, Aluminum, Steel

⚡ Main product grades provided by Oristar: Aluminum alloys, Copper alloys, Aluminum alloy plates, Aluminum coil grades, Tool steel, Special steel: A5052, A6061, A7075, C1100, C2680, C3604, SUS303, SUS304, SKD11, SKD61,...

For product consultation, please contact:

⚡ Hotline: 0988 750 686

⚡ Email: info@oristar.vn

⚡ Zalo OA

⚡ ️Website E-commerce

⚡ Official Website

VN

VN

EN

EN

KR

KR

JP

JP

CN

CN

Economy

Economy