Trump's tariffs, US-China trade relations, and a wave of AI investment are among the issues that could shape the global economy in 2026.

US tariff policy

The Organization for Economic Cooperation and Development (OECD) forecasts global trade growth in 2026 to slow to 2.3%, from 4.2% in 2025, due to the full impact of US tariffs on investment and consumption.

OECD Secretary-General Mathias Cormann said the impact of US President Donald Trump's tariff policies has been relatively mild so far and has not yet fully taken effect. "The full impact will be clearer from early next year, when companies' stockpiles have decreased," he said.

Currently, the average import tax rate to the US is about 16%. In an optimistic scenario, the Dutch investment bank ING believes that this tax rate can be reduced in two ways. One is that the Trump administration proactively reduces the tax rate before the midterm elections next year, similar to the recent move on agricultural products .

Second, the Supreme Court rules that the tariffs imposed by the President under emergency powers are illegal and should be repealed. At that point, Mr. Trump would need to cite other legal grounds to impose the tariffs. But overall, either approach would lower average U.S. tariffs, which would help reduce inflation and boost GDP.

US-China trade relations

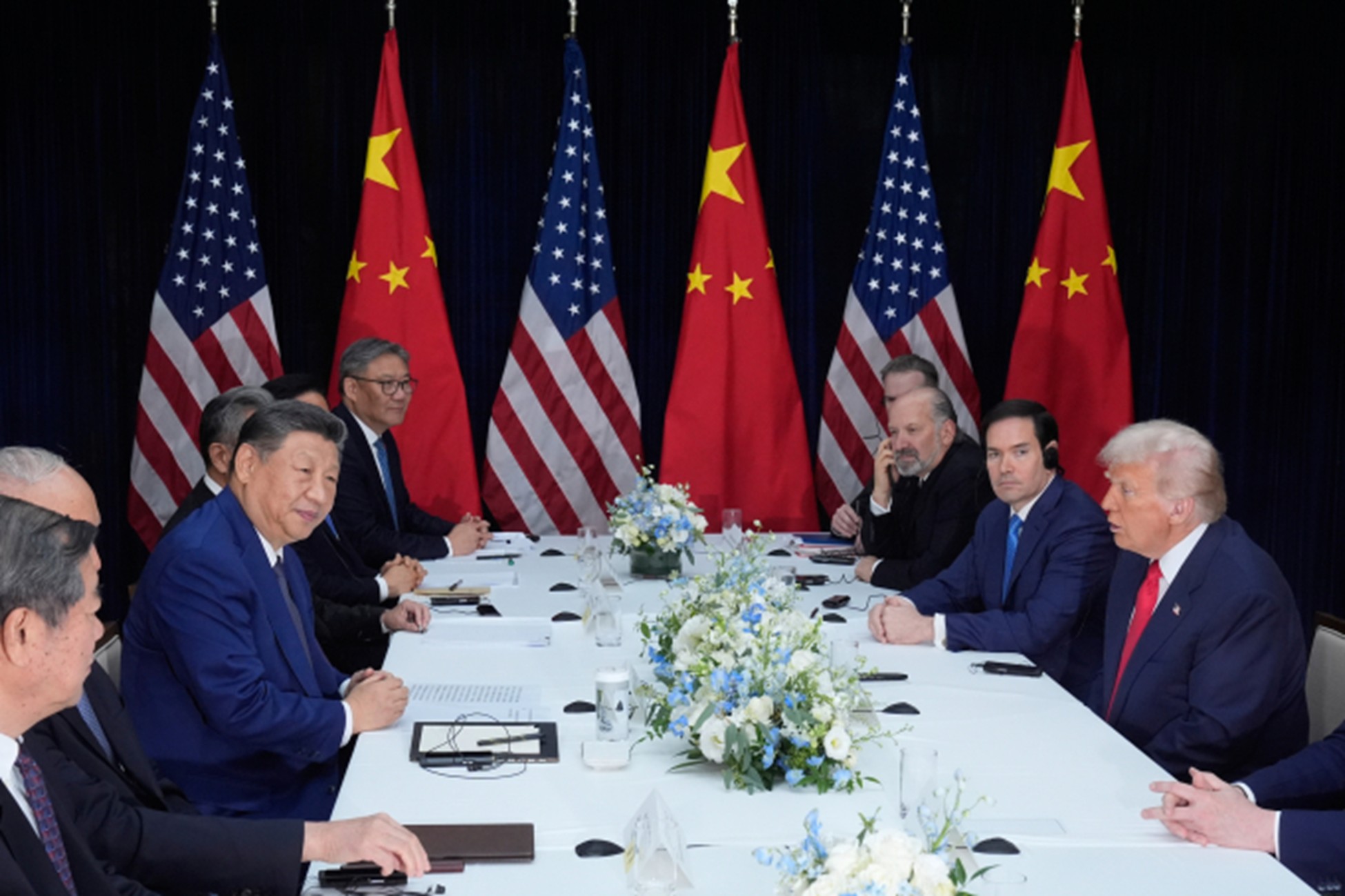

Trade tensions between the world's two largest economies have cooled after a face-to-face meeting between US President Donald Trump and Chinese President Xi Jinping in October, leading to a decision to extend a truce and remove other trade barriers.

Last week, Trade Representative Jamieson Greer said China had complied with the terms of the bilateral deal and fulfilled about “one-third” of its soybean purchase commitment for this season.

On December 5, Mr. Greer and US Treasury Secretary Scott Bessent had a "deep and constructive" video call with Chinese Vice Premier He Lifeng. The two sides pledged to maintain a stable relationship and address "respective concerns" on trade and the economy, according to Xinhua .

The development opens up a positive outlook because in theory, the world's two largest economies will keep tariffs and export controls in place for much of 2026. However, ING said the deal remains fragile and any missteps could cause instability again.

In a worst-case scenario, non-tariff barriers from China such as controls on rare earths could be tightened, leading to shortages and rising prices of chips, cars and defense products, leading to higher inflation.

President Donald Trump and Chinese President Xi Jinping hold talks in Busan, South Korea on October 30. AP photo

Oil prices depend on geopolitics

The US Energy Information Administration (EIA) forecasts that crude oil prices will continue to fall as global inventories continue to rise. The agency expects Brent crude oil prices to average $69 per barrel this year and fall to $55 per barrel by 2026.

In a downside scenario, oil prices could rise if geopolitical tensions escalate. ING said the biggest risk is supply disruption from Russia, which produced 9.3 million barrels a day in October, accounting for 9% of global supply.

Advertisement

Production could be affected if the US and its allies tighten sanctions and Ukraine attacks its energy infrastructure. The G7 recently proposed replacing the price cap with a complete ban on Western shipping lines carrying Russian oil, expected to take effect in early 2026.

Many experts believe that Russia will still be able to evade sanctions. If the blockade is tightened, the average price of Brent crude oil next year could reach $57 per barrel. In addition, the recent escalation between the US and Venezuela has also created uncertainty about Venezuelan supplies. Meanwhile, the fragile Israel-Gaza ceasefire raises the risk that Middle East supplies could return.

Budget deficits in the West

Bond investors have so far remained largely indifferent to the large US budget deficit. But the country's fiscal situation is very fragile, according to ING. The budget deficit is projected to remain at 6-7% for an extended period.

So there is a risk that investors will balk at new US government bond issuance, especially if fiscal spending is excessive amid signs of a return to inflation and loose monetary policy.

Europe is also vulnerable. France’s debt situation could spread as spending pressures increase, especially on defense. Bond yields could spike, and the economic impact depends on the central bank’s response.

Without large-scale purchases of government bonds by central banks, Western governments will be forced to make austerity choices, resulting in lower growth.

Mr. Trump gives $2,000 to each citizen

In mid-November, US President Donald Trump proposed giving 150 million people a " tax dividend " worth at least $2,000. Observers said this was part of an effort to ease pressure on the Republican Party before the midterm elections, especially on the issue of rising living costs.

The idea is reminiscent of the Covid-era stimulus package, with money handouts that fueled inflation. ING estimates that about 60% of US consumers would have access to the “tariff dividend” package if implemented, helping boost US growth.

However, the growth boost will be weaker than the pandemic stimulus, while inflation is likely to rise, making the Fed more hawkish.

Prospects of Europeans loosening their purse strings

According to the European Commission, consumer confidence in the EU fell to -13.6 points in November, from -13.5 points in October. To put that in perspective, the index hit an all-time high of -1.9 points in December 1989 and a record -28.3 points in September 2022.

While spending cautiously, Europeans are saving aggressively. The eurozone household savings rate rose to 15.4% in the second quarter, up from 15.2% in the first quarter and about 3 percentage points higher than before Covid.

After the 2022 energy crisis, Europeans have had time to rebuild their savings, helped by stable inflation at 2%. Therefore, ING predicts that consumers here can start spending more freely in 2026.

The momentum will be even stronger if governments resolve policy uncertainties around pensions. In this scenario, eurozone growth could be higher than the current trend, at around 1.5% a year, allowing the European Central Bank (ECB) to raise interest rates by the end of 2026.

China real estate market

After stabilizing in early 2025, the decline in China’s housing market accelerated again from mid-year. Falling prices, high inventories, and weak real estate investment continue to weigh on the world’s second-largest economy. Fears of developer defaults have returned, with Vanke recently requesting a one-year deferral of bond payments.

Beijing rolled out a slew of market support policies in 2024 but interventions have been less frequent recently, with growing calls to let the market fully adjust over the next few years.

However, this could have consequences if left unchecked. Household wealth is at risk of falling, bank asset quality is deteriorating, and there is persistent pessimism. All of this is a headwind for China’s efforts to shift to domestic demand-led growth, dampening short-term prospects.

Risks surrounding the AI investment wave

Many economists expect AI to boost productivity and reduce inflation. But there are other risks. ING says that in the short term, large investments in AI infrastructure could crowd out other economic activities. For example, data centers are expected to account for 10% of US electricity demand by 2030.

Globally, energy pressures could push up prices and threaten power shortages. Massive investment in AI could also lead to a shortage of workers in infrastructure and construction, as the US and Europe tighten immigration. This could lead to rising wages, inflation, and central banks tightening monetary policy.

In addition, the wave of AI investment continues to question the effectiveness of billions of dollars poured into hardware, software and related industries. In the US, the AI " bubble " scenario will cause technology company stocks to plummet, affecting the 20% of high-income Americans.

A decline in household wealth will lead to a decline in consumption in 2026. Overall, if the AI "bubble" bursts, the US risks falling into recession, the Federal Reserve (Fed) will cut interest rates more strongly, while Europe will be less affected.

The possibility of ending the Ukraine conflict

In 2026, if the Russia-Ukraine peace talks are successful, the economic impact will depend on how well the two sides resolve difficult issues, such as territorial recognition, and the sustainability of the agreement.

In an optimistic scenario, where a credible long-term deal is reached and investors feel reassured, the reconstruction effort in Ukraine would have a major spillover effect on the economy, especially on confidence in Eastern Europe.

Lower energy prices, thanks to the lifting of Western sanctions on Russian oil following the end of the conflict, will also stimulate global consumption. However, the impact will be limited as Russia has maintained relatively good supply over the years.

Meanwhile, the impact on gas markets would be greater if Europe resumes gas consumption from Russia. Lower energy prices will generally boost global growth, which could lead some central banks to shift to a more dovish stance as inflation risks fade.

--

Oristar – Leading Metal Supplier in Asia

⚡ Core product lines: Copper, Aluminum, Steel

⚡ Main product grades provided by Oristar: Aluminum alloys, Copper alloys, Aluminum alloy plates, Aluminum coil grades, Tool steel, Special steel: A5052, A6061, A7075, C1100, C2680, C3604, SUS303, SUS304, SKD11, SKD61,...

For product consultation, please contact:

⚡ Hotline: 0988 750 686

⚡ Email: info@oristar.vn

⚡ Zalo OA

⚡ ️Website E-commerce

⚡ Official Website

VN

VN

EN

EN

KR

KR

JP

JP

CN

CN

Economy

Economy